10 step martingale forex

Why double when losing. Ideally this strategy takes place when there is a 5050 chance of.

Binary Options Stratagies Binary Options With Martingale Strategy Binary Options For Beginners Trade Ma Stock Options Trading Forex Trading Option Trading

We have a profit-making system.

. Weve decreased the minimum win rate. However even so you still need to. 1 ratio is much easier than if this proportion is 110 or 1.

Major money is earned by trend trading. The automated trading system works as follows. If the roulette hits black again then you bet 4 on red.

If you lose double the investment and keep opening orders until you win. The idea behind the system is very simple. Your long-term expected return is still exactly the same.

At its basics martingale trading encourages you to double the amount of money you invest in a losing position at intervals until you break even or bag some profits. Martingale can not be used unless your mind is calmed down. A Martingale forex strategy offers a risky way for traders to bet that that long-term statistics will revert to their means.

Move the protective stop from order 1 by trailing etc. If you win on any order return to 5. Why Martingale strategies are attractive to forex traders First under ideal conditions.

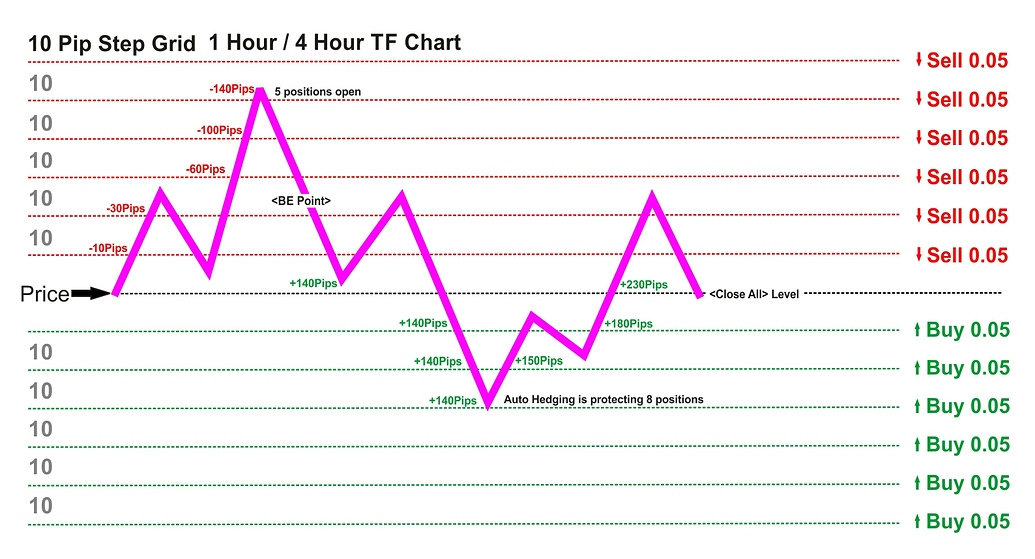

The system immediately sets a fixed Profit target the Stoploss order is not set. The number of lots traded will determine the number of double-down trade legs that can be placed. The Martingale strategy is a system of trading based upon negative progression.

Martingale is a cost-averaging strategy. The best opportunity for this strategy is when one of your trades only has a 50 chance of succeeding which can be seen as having no expectation of winning or losing. The important thing to know about Martingale is that it doesnt increase your odds of winning.

Suppose i have a trading system that when gives a 11 riskreward signal can win at least 20 of the times for example. For traders willing to risk a Martingale forex strategy the first thing to decide is the position size and risk. This results in lowering of your average entry price.

This Anti-Martingale variation suggests that you stop betting after a streak of a predefined number of wins and then start a new cycle with a minimum bet amount. The Secret to Success. Start protective stop at x pips and open third order in the same direction with the same lotsize.

What is the Martingale Strategy. You trade with the Martingale method and start at 5. According to Forex Signal 30.

The system was initially developed to be applied to roulette. These strategies are risky and long-run benefits are difficult to achieve. Simply put to succeed when the odds are distributed in a 1.

Loss - Loss - Win. It could be something like this. Have a look at a BGP.

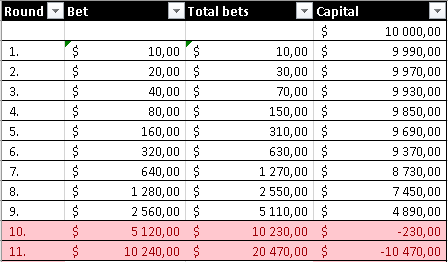

More precisely it advocates for doubling up after each loss. The Martingale strategy therefore aims to double the trade size after a loss in order to eventually recover once your trade does succeed. Your total capital is 315.

20 points these are all scenarios we have when receive signals. Some theories on position sizing derive from games of chance - specifically from betting progression systems. It is derived from the idea that when flipping a coin if you choose heads over and over you will eventually be right.

The first trade longshort is completely random. To keep this example simple lets use powers of 2. This means that following a loss traders who adhere to this strategy will increase their position size.

Loss - Loss - Loss - Win. Forex traders use Martingale cost-averaging strategies to average-down in losing trades. The Martingale strategy is based on the principle of probability.

How to calculate the drawdown limit for a Martingale forex strategy. Start protective stop at x pips and open secondary order in the same direction with the same lot size. On the other hand the pair could move up and leave you with a loss.

Strengths and advantages of Forex resulted in reduced win rate requirements. It assumes that a price action of a security will often retrace. So your cycle will consist of up to 6 orders as follows.

If you bet 1 on red and roulette hits black then you bet 2 on red. Then well explore Forex Martingale trading within FX trading. Results of martingale in forex trading.

By using the Martingale strategy the number of lots that opened after a defeat must be 2 times higher than before the lot number is always 1 step ahead of the previous defeat so that if they win then the previous defeat can be closed at the same time get profit. Okay dudes im gonna share a strategy. To the one and only transaction that can bring the expected profit.

If the position reaches a negative result which equals the value of the profit target the next position is open. In this case each losing trade in this case should be considered as a step towards success. Though the coin may land on tails 2 or 3 or 10 times in a row it MUST eventually land on heads.

In a Martingale system you take advantage of this truth by. Unfortunately martingale demands to have an. Trade is taken easier now.

For example if you sell the EURUSD pair that is trading at 11200 on Monday the pair could go down and make your trade profitable. 5 10 20 40 80 160. Trading is not the place for emotions.

20 points and SL. Martingale trading in Forex is a strategy used by traders to double down their losses in hopes of increasing their profits. First we will take a look at Martingale in its original context of a game of chance.

This article discusses Martingale trading which is a position sizing strategy. It does this by doubling exposure on losing trades. The idea of Martingale is not a trading logic but a math logic.

Compare your trade with the option we set out below and if some components are missing update your system. If the roulette doesnt hit red again then you should bet 8 16 and so on until you get a win.

Divergencemacd Indicator Mq4 Forex Forex Trading Trading Charts

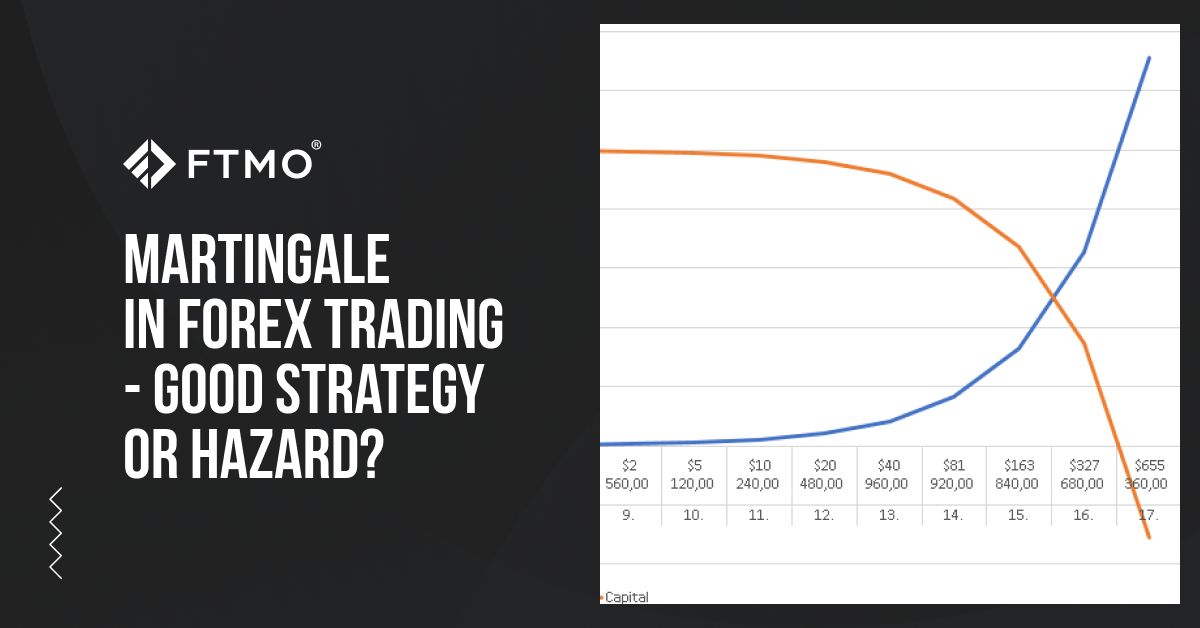

Martingale In Forex Trading Good Strategy Or Hazard Ftmo

Martingale In Forex Trading Good Strategy Or Hazard Ftmo

The Hype Around Martingale Trading Strategy Forex Trading Blog Forex News Articles And Market Analysis Fxcc

Wd Binary Bot Smart Martingale System V4 1 Binary Com Bot Martingale Binary Forex Trading System

Bots Software Chart Money Management

The Martingale Strategy In Forex Trading Market Business News

98 Best Modified Martingale Strategy Rsi Moving Average Martingale Trading Strategy Youtube

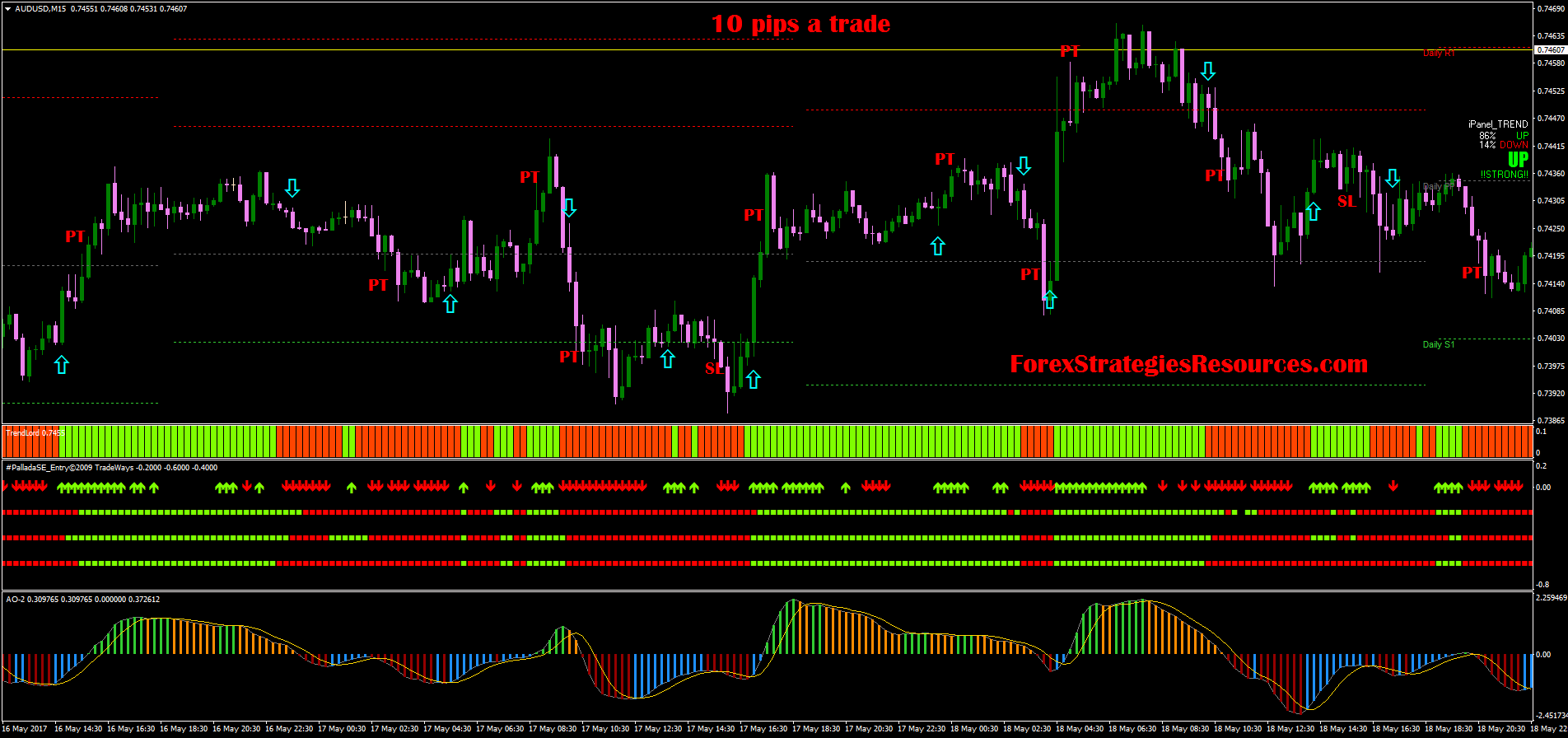

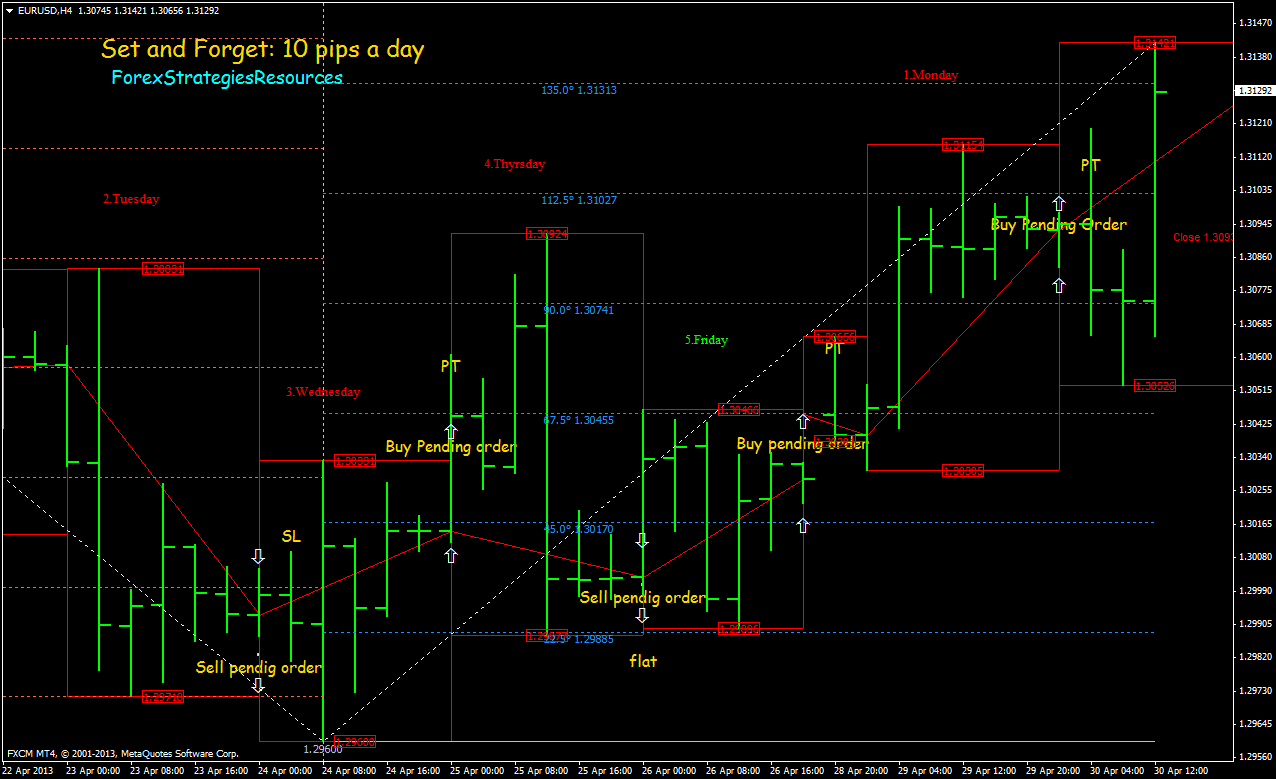

10 Pips A Trade Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Martingale Trading Strategy How To Use It Without Going Broke

10 Pips A Trade Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Is There Really A Special Forex Secrets In Forex Market Trading Psychology Babypips Com Forum

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg)

Understanding Forex Risk Management

Super Martingale Ea Tested With Over 113 333 Profit Forex Trading System Automated Trading Forex

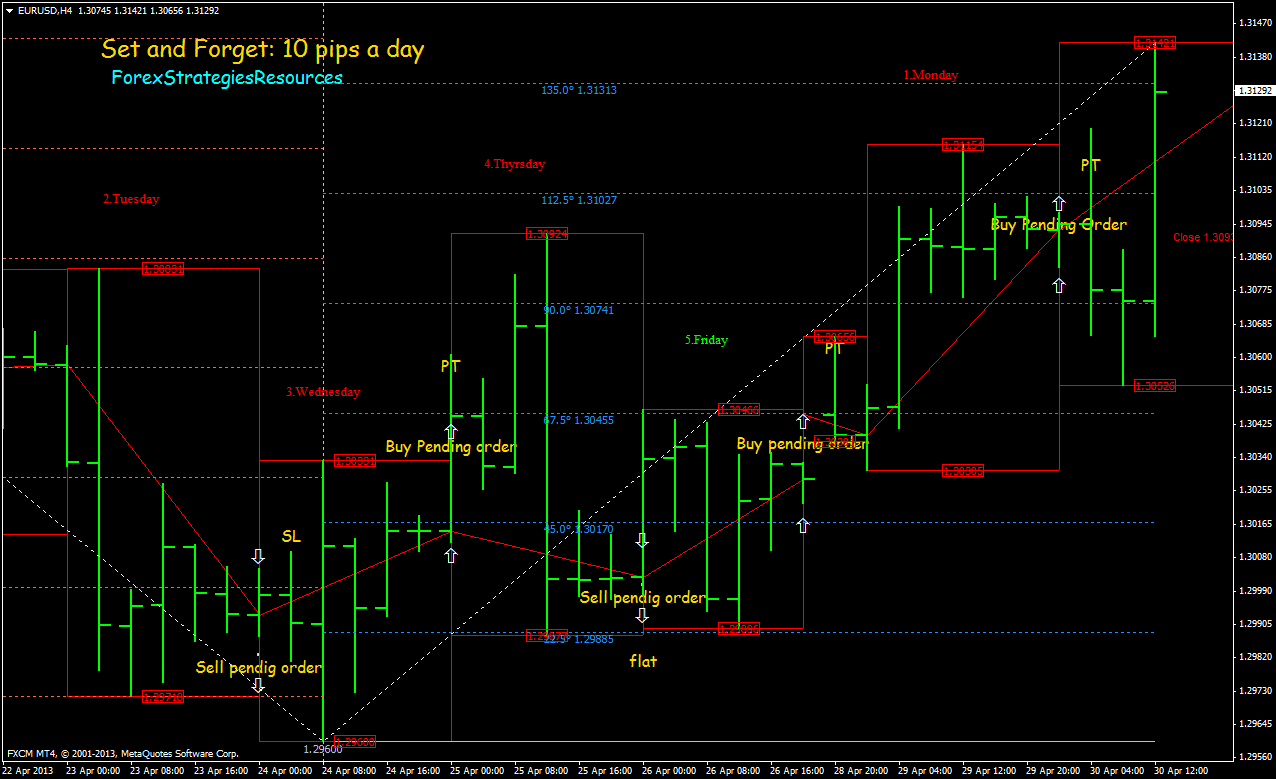

47 Set And Forget 10 Pips A Day Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast